Investments

Our ethos is simple - with great personal care, we provide truly independent financial advice for both individuals and businesses.

In response to the strategic review of our investment proposition, combined with increasing regulatory scrutiny, we have developed an investment advice process to deliver a set of robust solutions for clients. The client outcomes have been developed following rigorous research within the marketplace and form a strategic response to the Financial Conduct Authority's treating customers fairly initiative and the retail distribution review. Our investment advice process will help us adopt a focused and consistent approach, reduce regulatory risk and deliver a competitive client service proposition. It will be overseen by our investment committee.

By working in unison with our professional connections, you can expect an efficient, accurate service and our expert knowledge ensures the provision of high quality advice. We always put the needs of our clients first and work together to deliver the most effective solution. Providing unbiased objective advice, we will help you to identify your goals and then recommend the most suitable action from the whole range of solutions available. As part of this we incorporate investment specialists to manage funds so that we can focus on strategic planning.

Being client focused, we promise to treat you with respect and professionalism at all times, making certain that you fully understand any decisions that you make. With total transparency, you can be confident in the advice you receive and trust that it is totally tailored to you. It is vital that when selecting an adviser you establish whether they are an Independent Financial Adviser or Restricted. All of the advisers at Nurture Financial Planning Ltd are Independent Financial Advisers and will only restrict advice at your request.

Quick links to topics covered on this page are below, click to go straight to the topic:

- Investment Overview

- Reviews

- The Relationship Between Risk and Reward

- Risk profiling

- The True Cost of Loss

- Active versus Passive Investing

- Blended funds

- What Are the Different Asset Classes?

- What are your motives for Investing?

- The Range of Solutions offered by Nurture Financial Planning

- Managed Portfolio Solutions Including Model Portfolios by DFM'S

- Investment Process

- Risk Ratings

- General information on ISAs, Asset-backed Investments & Deposit Based Investments

Investment Overview

Click here to learn about the different investment vehicles available to the individual investor together with the key points to note. This is an at-a-glance guide with more detailed information contained in other sections of this page.

Reviews

Over time your objectives are likely to change and consequently the mix of investments may no longer meet your needs. As part of the overall service proposition Nurture Financial Planning will periodically review your circumstances to ensure that the recommendation continues to meet your needs. The frequency of the reviews will be agreed with your financial adviser and further detail can be found in our 'Guide to our Services' booklet.

The Relationship Between Risk and Reward

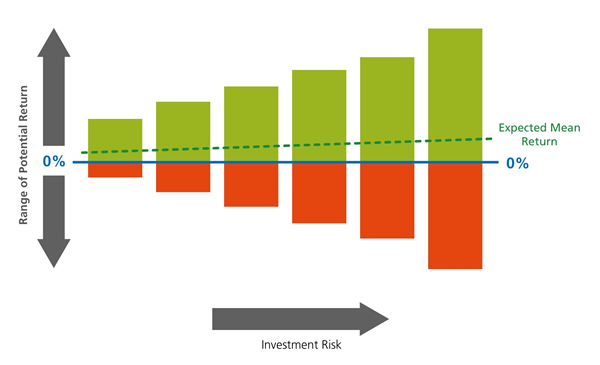

Investment risk and return are directly related. In theory, the greater the risk of an investment losing money, the greater the potential for making money. Or to put it another way, if an investment is very risky, the potential for high returns is very high. Equally, if an investment is considered to be very low risk, the potential investment return may also be low. Other factors you will need to consider for investments are; how long you want to invest the money for and whether you need quick access to it at any time during the investment period. Can you afford to lose some of your investment, if so how much before it impacts on your standard of living.

When making decisions on how to invest, you have to balance the risk and the return. If there is an investment opportunity with lower risk and a potentially better than average return, this could be a better option for most people than an investment with potentially much greater return and a higher risk. The relationship between risk and reward can be illustrated by the graph below:

Here are two extreme examples:

- Investing in stocks on the stock market can be very risky, as the chances of making a profit are difficult to predict; with volatile (fast moving) stocks, profits can be very high and so can losses - therefore extreme caution is required.

- Putting your money in a bank or building society savings account carries a very low risk, but the returns (the interest you earn on the money in your account) are also relatively low. The savings could also be eroded by the effects of inflation, thus reducing the 'true value' of the money deposited.

Risk profiling

Our risk profiling techniques help determine the appropriate portfolio best able to meet your long-term aims and objectives and capacity for loss. Whether you are a cautious investor or speculative, we can build a strategy to meet your expectations. The returns you expect to receive may not be what is actually achieved. It is therefore important you understand the implications of having an investment strategy designed to achieve a certain objective which may have a level of risk above or below that which the risk assessment has determined. It is our belief that the key to a successful strategy is driven by the need to manage the level of volatility and therefore risk of your portfolio.

Volatility is the amount by which a portfolio can fall and rise in value, so a lower risk portfolio will fall and rise to a lesser degree than a higher risk portfolio. We often use multi-manager portfolios that have clear objectives to ensure that you have a broad investment mix to provide diversification.

A managed volatility strategy seeks to mitigate the risk of a steep decline in a specific investment. It seeks to achieve a balance which will cope with the impact of market fluctuation upon a specific investment. Picture someone walking in a straight line along the beach while their dog zigs and zags from the dunes to the surf. Both are headed in the same direction and end up in roughly the same place, but one takes a more direct path, while the other travels a more exhausting route. If the dog's trail represents the stock market's path, then the person's less erratic course represents the ideal path managed volatility is expected to take.

The True Cost of Loss

With advances in technology, the advantages of portfolio diversification are well known. A less well known advantage of focusing on risk rather than return is that the compounded return of a low volatility strategy will be higher than the return of a high volatility strategy with the same arithmetic average return (see example). This follows from the asymmetric impact of positive and negative returns. If a portfolio loses 20% in one month, and gains 20% the next month, the portfolio will still have an overall loss of 4%. To recover fully from the loss of 20%, the portfolio actually needs to gain 25% the next month rather than just 20%. The impact of returns increases with volatility. Assume that a portfolio loses 50% in one month: to recover this loss the portfolio needs to gain 100% the next month. In the graph below it can be seen how the gains required to recover from a loss increase disproportionately with the size of the loss.

Active versus Passive Investing

What is Passive Investing?Passive, or 'index', investing is a strategy that aims to match the returns from the stock market, as measured by an index such as the FTSE 100 Index of leading companies in the UK. A large number of 'index tracker' funds and, a more recent development, 'exchange-traded' funds, are available to allow investors to track the market in this manner.

Why invest passively?

Perhaps the main attraction of passive investing is that passive fund charges tend to be lower, sometimes much lower, than for 'active' funds. That's because they don't need to pay for the fund managers and support staff, such as research analysts who are typically involved in active management. Passive funds can be easy and quick to trade in and out of. Exchange-traded funds, for instance, can be bought and sold throughout the trading day. They are also highly transparent -investors know at any time more or less exactly what is held in their fund. Importantly for some investors, by 'tracking' the market, passive investing generally avoids the risk of underperforming the market return by a large margin. Disadvantages include the lack of choice and less potential for out-performance over and above the average rate of return. There could also be inadequate diversification and untimely changes to the funds could be made in order to 'rebalance' or reflect a particular index. Difficulties in diversification Indices tend to be dominated by the largest companies and sectors. For example in June 2013 over 27% of the FTSE 100 index was concentrated in just two sectors - oil & financials. Being concentrated in the largest companies and sectors can sometimes lead to the heaviest losses. When the "dotcom" bubble burst in 2000, for example, one sixth of your portfolio might have been invested in just one stock! When investing do not solely base decisions on past performance. Prices may fluctuate and you may not get back your original investment.

Active investing is a strategy that aims to beat the returns from the stock market. There are many different ways in which active funds seek to achieve this objective. Common to all, however, is the belief that, using skills and proven investment processes, it is possible to beat the market. Active funds fees are usually greater than those for passive funds, but so too are the potential rewards.

Why invest actively?

The large majority of UK funds are managed actively. Why? Because investors prefer that their capital is allocated according to the judgment of a skilled professional, rather than have its fortunes left to the whims of a market index or a computer programme. Active funds are not tied to the stock or sector weightings of an index. They have specific performance objectives, with managers selecting stocks according to individual investment strategies. The managers of active funds can make informed decisions to exploit the inefficiencies of the market. They can anticipate changes in market conditions, and adjust the balance of their funds accordingly thus ensuring the opportunity to outperform both passive funds and the relevant sector. An active investor can choose between many management styles and strategies. He/she can invest for capital growth, income; value; or take a contrarian approach - for example, buying companies that are 'unloved' but which have potential, then selling when everyone is buying.

Blended funds

Put simply, a Blended fund is a combination of both passive and active investment styles and is designed to offer factors from both styles in one investment solution. These funds are designed to combine active management in areas where value is most likely to be added but also to benefit from the lower costs of passive investment strategy to track stock market indices and the use of a more active approach for specific investment areas of sectors. Another feature of a Blended Fund is the ability to access a wide-ranging investment remit by choosing combinations suitable for all economic situations. In addition, the ability to access a value manager, a growth manager, a contrarian manager and combine this with passive strategies gives the Blended approach a huge spectrum of combinations.

Why we don't pick individual investment funds?

The way we work at Nurture is to look at what a client values most from their financial planner and to provide a service that meets that need. We believe our time is best served discussing financial planning and making the most efficient use of your tax allowances than trying to determine which individual investment fund should be bought or sold. We also believe that it is right to concentrate on doing what you are good at and not try and attempt to be good at something where you have little time, qualifications or expertise to do so. We all like to do things ourselves but sometimes you should use an expert in that field to do that specific job for you. To use an example, how many of us would have the expertise to rewire our home, or to build an engine? Of course, we may be able to learn or attempt both jobs, but how many of us could be confident that the job would be expertly done? Would it be reliable? Fund selection is no different.

Then there is the speed of change in the world we live in today. Information is instant and economic and political factors influence investments, both domestically and internationally. These events can potentially impact on your money. In our view, it is no longer enough to wait until the next time you see a client for those changes to take place, they need to be done straight away. Fund managers have experience and specific investment qualifications. Their teams have these qualifications and the analysts within these teams constantly monitor the economic world to make sure that their fund can adapt. In addition, how many individual funds consistently deliver performance year on year to their investors? How much do they charge for this service? If your adviser has several hundred clients how can they monitor every single fund daily and make changes straight away.

Which type of investment is going to do well this year? Will it be the same as last year? The answer to that question is almost universally no.

We believe that the best approach for our clients is to use a multi asset fund, a model portfolio service or a discretionary fund manager within chosen risk parameters which our client is comfortable with. We will monitor the ongoing suitability of your chosen strategy to ensure it is still appropriate for you and will leave the investment decisions within these funds to the experts.

What Are the Different Asset Classes?

There are countless potential investments in the financial world: equities, bonds, government stocks, unit trusts, OEICS, cash and property.

Cash

Within client portfolios we may retain money on deposit. Depending upon prevailing interest rates, this will attract interest on the capital value. Advantages include its capital stability. It is extremely secure and liquid. Disadvantages may be that over the long-term the real value can be eroded by the effects of inflation and interest rates can be variable.

Fixed Interest

Fixed interest securities are loans made by the investor to the issuer of a bond. Issuers include governments, companies and local authorities. In return for the loan, the issuer provides a fixed percentage payment over the term of the loan together with the return of the initial investment. The risk associated with these investments varies from low risk government securities to higher risk instruments in the corporate sector. Care must be taken when investing in these areas to understand the different risks relating to each issuer and security. Advantages include the ability to inflation proof in some circumstances whereas other opportunities include certainty of capital and income for fixed periods of time. The main disadvantages are that capital values can fluctuate, higher risk instruments such as high yield corporate bonds carry a higher risk of default, and over the long-term the real value of conventional fixed investment returns can be eroded by the effects of inflation.

UK Equities

Equities offer an investor the opportunity to purchase part of the ownership of a company. They offer the potential for attractive investment returns above inflation, but can have a much higher degree of risk than many other asset classes. The success of a company can be dependent on a number of factors such as its market position, quality of management and background economic conditions. In return for their investment, shareholders look for a return generated in the form of dividends, appreciation of the share price or both. The main advantage is the potential for long-term capital and income growth over and above inflation. Whereas equities do carry a high degree of volatility and the potential for loss of the capital invested. In addition, whilst most companies aim to increase dividends, these can be cut if the financial position of the company deteriorates.

Overseas Equities

These offer many of the characteristics of UK companies but give greater diversification than can be obtained in the UK market alone. This diversification can be geographic, giving exposure to areas of the world expected to deliver better performance than UK equities, exposure to industries that are not easily accessible through the UK market. As with UK based equities, overseas investment offers the potential for long-term capital and income growth over and above inflation. In addition, currency fluctuations could enhance returns and potentially there is exposure to faster growing economies and industries not quoted in the UK. However, a high degree of volatility is associated with this fund sector giving the potential for loss of capital invested. Often overseas equities may offer lower income yields and fluctuating currency rates could diminish investment returns whilst further risk is added by the differing regulations and accounting standards demanded in the countries invested.

Hedge Funds and Multi-Strategy Funds

These funds allow the manager the flexibility to use a variety of investment techniques and strategies with the aim of achieving positive absolute returns. There is a vast range of hedge and multi-strategy funds offering substantially different risk profiles. These funds have little or no correlation with more traditional asset classes but do offer attractive diversification benefits that sometimes offer protection from the downside. The sector can most sensibly be accessed through funds of funds. These types of funds can offer the potential for positive returns in any market conditions, diversifying risk and in some cases protecting capital in falling markets. Access via funds of funds can offer lower degrees of risk when compared with traditional asset classes. However, sometimes funds can be illiquid or have long redemption periods and care should be taken when investing as some funds may adopt high levels of gearing which can increase volatility.

Property

Commercial property investment can include assets held in physical property, property shares and other property related investments. These types of funds aim to produce both capital growth and income and provide a useful alternative to investing directly in property which can be extremely illiquid. Although not directly correlated to equities, property funds are correlated to interest rates and therefore fixed interest assets. These types of funds generally provide stability with a high income return. The main disadvantages with these types of funds is that they can sometimes be illiquid and capital values can fluctuate due to the cyclical nature of the property market.

What are your motives for Investing?

Before agreeing a strategy, we will assess your motives for investing as this can have a significant impact on your planning. Investors have different motives for investing:

- Some want capital growth; some a steady income.

- Some want steady, secure returns through investing in low-risk, however some are willing to take on more risk for potentially higher returns.

- Some are simply looking to diversify their portfolio by investing in a wide range of companies.

The Range of Solutions offered by Nurture Financial Planning

Multi-Manager (MM) Strategies

Usually, a fund has a single manager who invests the fund's assets in order to achieve the fund's objective. A multi-manager fund is different because, although the fund is still run by an overall manager, the assets are invested according to the opinions and forecasts of several managers. By having specialist managers to oversee different parts of the fund, multi-manager funds aim to benefit from in-depth investment expertise.

Main Advantages

Expertise - We believe fund manager expertise is one of the most important attributes of multi-manager funds. This is why we place such huge importance on highly experienced and knowledgeable Investment teams. With dedicated investment professionals looking after your money, multi-manager funds aim to provide focused investment expertise across a wide range of markets and assets. As well as providing the reassurance that clients' investments are being managed and monitored by experts. The managers of the component funds which make up multi-manager investments are well placed to thoroughly understand the markets they work in, respond to changes quickly and anticipate future developments. Portfolio construction - ensuring that portfolios control risk and meet clients expectations is a meticulous and ongoing process. Portfolios must be regularly monitored and, if necessary, realigned to ensure they meet their objectives. Multi-manager funds provide a straightforward answer to this dilemma, employing experienced investment managers to ensure investments are diversified and well-balanced.

Considerations

Management fees are typically higher than those on traditional investment funds because they include the management fees charged by the underlying funds.

Fund of Funds (FoF)

A Fund of Funds is an investment strategy much like the Multi-Manager. Funds may be 'fettered', meaning that it invests only in funds managed by the same investment company, or 'unfettered', meaning that it can invest in external funds. There are different types of 'fund of funds', each investing in a different type of collective investment scheme (typically one type per FoF), for example mutual fund FoF, hedge fund FoF, private equity FoF or investment trust FoF. Investing in a fund of funds may achieve greater diversification thus reducing volatility. Depending on the objective, some may simply aim for average returns whereas more actively managed schemes may aim for higher returns. However, this is countered by the increased fees paid at both the FoF level, and of the underlying investment fund.

Managed Portfolio Solutions Including Model Portfolios by DFM'S

An alternative to the 'active' or 'passive' risk models are managed portfolio solutions. These use a combination of passive and actively managed as well as a wide range of other investment vehicles. They are used to deliver an asset allocation model that is rebalanced regularly. These solutions utilise the in-house research capabilities of the investment manager (usually a Discretionary Fund Manager - see below) to ensure the selected funds and fund managers are delivering the desired result. If necessary, funds will be replaced if they do not continue to meet the standards required.

Bespoke Discretionary Fund Management (DFM)

Typically for more sophisticated investors who wish to have a higher level of input, your portfolio may be managed discretionarily. This means that even after the first investments have been made, the investment managers can act quickly to make changes as required: monitoring your portfolios each and every day, picking the right funds, researching new opportunities and rebalancing to make sure that your strategy remains on target. DFMs have access to the very best available investments across the entire financial market, using the services of both large recognised institutions and smaller specialist boutiques.

Investment Process

At Nurture Financial Planning we adopt a five step investment process:

Step 1: This involves identifying your requirements by means of a structured fact find, risk assessment and talking through the various solutions that may be appropriate to meet your needs and objectives.

Step 2: From the assessment of your risk tolerance level an asset allocation profile will be determined. What this means is that a mix of the available types of investments would be put together to ensure your requirements are met. Included within this consideration, amongst other things, will be the length of time the investment will remain invested, any income requirements or growth objectives etc.

Step 3: Once the mix of the different types of investments has been determined then funds will need to be selected in order to meet your risk requirements. At all times Nurture Financial Planning will utilise the expertise of specialist fund managers to make the appropriate fund selection which may include Risk Constrained funds. Nurture Financial Planning will not make individual fund selections.

Step 4: Monitoring and rebalancing of portfolios will be undertaken by the same investment specialists who have selected the funds in Step 3. It is Nurture Financial Planning's belief that utilising the services of specialist fund managers gives the best possible protection for our clients.

Step 5: Depending on your circumstances and requirements, you may want to receive ongoing advice regarding your investment. The content and frequency can be discussed with your financial adviser and tailored to meet your individual requirements. When receiving ongoing advice a recommendation will be given for any changes needed to take into account your new circumstances or objectives.

Risk Constrained Funds

Our Risk Ratings

Using the Industry leading research tools available to us we measure your individual risk rating on a score of 1 to 5, with 1 being low and 5 being high. Within this we have three separate time horizon levels of short, medium and long, which in turn gives us a total of 15 individual risk ratings. Because one person has the same (1 to 5) score as another we felt that the differing time horizon ratings allowed us to be more refined in our choice of suitable investment types for our clients.

A short term investment horizon would be between 5 and 10 years. A medium term investment horizon would be between 10 and 15 years. A long term investment horizon would be 15 years or more. A person's investment time frame is extremely important to make sure funds are available as and when they are required. In line with our review process available to our clients, the time horizon will change year on year so any reviews which we undertake will encompass any changes in the time period over which you intend to invest and we will adjust our recommendations based upon this if it is appropriate to do so.

At Nurture Financial Planning we have vigorous systems in place to ascertain your individual attitude to investment risk which fall within strict volatility bands, they are:

No Market Risk: You are not prepared to take any investment risk and it is important to you that your capital is protected from changes in market prices. However, you do understand that the general rise in prices (inflation) could reduce your spending power over time.

Cautious: You are prepared to take only a small amount of investment risk. This means that your portfolio will concentrate on investments that provide low returns in the long term but present lower risk to your capital. Only a small amount of riskier assets will usually be included in your portfolio in order to increase the chance of obtaining better long term returns. A typical Cautious investor will be invested mostly in fixed interest gilts and bonds as well as in cash, with a small element in equities and property that can boost longer term returns but are associated with more risk. Using a broad range of assets gives you a varied portfolio and that diversification helps to reduce the overall levels of risk.

Cautious to Moderate: You are prepared to take limited investment risk in order to increase the chances of achieving a positive return but you only want to risk a small part of your capital to achieve this. A typical Cautious to Moderate portfolio will usually have the larger part of the portfolio-invested in fixed interest gilts, bonds or cash that are low risk but offer potentially lower returns. The remainder of the portfolio will usually be invested in equities and property which can boost longer term returns but are associated with more risk. Using a broad range of assets gives you a varied portfolio and that diversification helps to reduce the overall levels of risk.

Moderate: You are prepared to take a moderate amount of investment risk in order to increase the chance of achieving a positive return. Capital protection is less important to you than achieving a better return on the investment. A typical Moderate investor will usually invest in a variety of assets to obtain diversification and therefore reduce risk. Equities and property, which can boost longer term returns but are associated with more risk, would often account for a higher proportion of assets than fixed interest gilts and bonds or cash. At shorter investment terms the proportion of higher risk assets is usually reduced. The range of asset types helps reduce the overall risks while increasing the chance of better returns.

Moderate to Adventurous: You are prepared to take a medium to high degree of risk with your investment/s in return for the prospect of improving longer term performance. Short term capital protection is not important to you and you are, willing to sacrifice some long term protection for the likelihood of greater returns. A typical Moderate to Adventurous investor will be invested in equities but with other assets included to provide some diversification. There may be a small amount of specialised equities within the portfolio, which focus on a particular sector of the economy or relate to a particular market or industry. Specialised equities can boost longer term returns but are associated with more risk than standard equities.

Adventurous: You are prepared to take a substantial degree of risk with your investment/s in return for the prospect of the highest possible longer term performance. You appreciate that over some periods of time there can be significant falls, as well as rises, in the value of your investments. This strategy holds significant risk in the shorter term. A typical Adventurous investor will usually be invested entirely in higher risk assets such as equities. There may also be a proportion of the investment in specialised equities, which focus on a particular sector of the economy or relate to a particular market or industry. Specialised equities can boost longer term returns but are associated with more risk than standard equities.

General information on ISAs, Asset-backed Investments & Deposit Based Investments

Individual Savings Accounts (ISAs)

Under the so-called 'New ISA' (or NISA), Cash ISAs and Stocks and Shares ISAs have effectively been merged, with the overall limit increased to £20,000 from 2017/18. Learn more here.

Asset-backed Investments

Here we attempt to explain in simple terms all the different asset backed investments open to the individual investor, from contribution levels right through to taxation treatment of each investment.

Deposit Based Investment

In this document we look at the various deposit based investment vehicles available in the marketplace today and what they mean to the individual investor.

Risk Warnings:

Investment into the vehicles mentioned in this document should be regarded as long-term and you should not invest capital that you may require in the short term.

The capital value of investments can fluctuate and may go down as well as up (unless held within a contract that offers particular guarantees). On encashment, particularly in the short term, investors may receive less than the original amount invested. Investors should be able to afford any potential loss.

Past performance is not a guide to future growth or rates of return.

You should be aware of additional risks associated with investments in emerging or developing markets.

The value of your investment may be affected by currency fluctuations if the fund has the ability to invest overseas.

International investments could be affected by local laws and accounting standards.

As is the case with any investment, there can be no guarantee that the tax position or proposed tax position prevailing at the time an investment is made in the Fund will endure indefinitely.

Property investments are relatively illiquid compared to bonds and equities and can take a significant length of time to trade.

Due to the higher costs associated with buying and selling property compared to bonds or shares, there may be a larger difference between the price you buy and sell units at.

Property valuations are determined by independent property experts and are based on opinion rather than fact.

Details regarding the volatility bands are available on request and subject to change.